Today’s world is running quite fast for college students as they have to face numerous challenges beyond academics. Financial barriers, increasing tuition fees, and the cost of living can place them in a very challenging position. Handling these costs adversely with no income is tied to cause a lot of frustration for many. In such a scenario, short-term loan app step out to become essential financial aid, offering students the necessary room for financing.

The Growing Need for Financial Support

College life is expensive. In addition to the tuition fee, students have expenses for books and living (accommodation, food, transportation, etc.). Though scholarships and part-time work can provide some assistance, they are often insufficient. That’s where short-term loans can provide speedy financial access for students at any time. An instant personal loan can address this financial gap that arises suddenly, thereby enabling students to concentrate on their studies without any financial distraction.

The Evolution of Student Lending

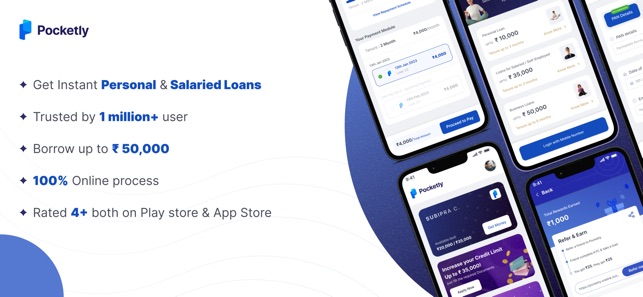

Historically, traditional banks were the main lenders to students. However, the long application processes, eligibility criteria, and collateral requirements made it impossible for a large number of students to receive funds. The lending domain has transformed in a revolutionary way with an instant personal loan app that offers students an attainable solution: They can apply for a payday advance with just a few clicks.

How Short-Term Loans Work

Short-term means that the loan will be repaid in a relatively short amount of time (usually within weeks or months). Our instant loans are short-term and have very small amounts compared to long-term loans, which means they can be used for things like renting a place to stay or emergency expenses. In the case of a loan, the biggest benefit is that it can be accessed without credit. Even students who have limited credit histories to their name might qualify, and funds normally dispense speedily.

Key consideration: Responsible Borrowing

Though short-term loans may be a lifesaver for students, responsible borrowing is the key. Before applying, students should also take the interest rates, repayment terms, and loan fees into account. You can also ensure that you are borrowing as little money as possible and have a clear plan for repayment. That is where the right loans app comes in, with tools to assist students in managing their finances and following repayment.

The Impact on Student Life

Enjoyed by many students, the availability of these short-term loans has only benefited their college experience for good. With the ability to money borrow when needed, students can avoid the burden of financial instability. College students also need a financial safety net to allow them to put more focus into their studies, personal development, and extracurricular activities — enhancing the quality of their time in school.

Selecting the Perfect Loan Provider

Students must pick the right loan provider for many reasons. These include factors such as interest rates, flexibility in repayments, and customer service. Digital lenders can help with that, and many have an online loan app that does the job. These apps could offer uniquely customized loan possibilities and in-depth knowledge of various terms and conditions to help students decide better.

In conclusion, short-term personal loan have become an essential financial tool for college students navigating the challenges of a modern busy life. In moderation, these loans provide some financial breathing room and help students concentrate on developing their academic knowledge and other areas of college life.