Hey there! Today, we will talk about something that can be a real lifesaver when you’re in a financial pinch: instant cash loan from borrow money app. These nifty financial tools offer a helping hand when you need it most. We’ll dive into why they’re awesome and how they can make your life easier.

1. Quick and Convenient Application Process

Imagine applying for a loan without leaving your comfy couch or standing in long lines at a bank. With an app to borrow money, that’s exactly what you get. The application process is easy and can be completed in just a few minutes. All you need is an internet connection and a device – a smartphone or a computer will do the trick.

2. Speedy Approval

One of the most significant advantages of instant online loans platforms whether its a website or any app for borrowing money, is the speed of approval. Traditional loans from banks can take weeks to process. But online loans can get approved within hours, sometimes even minutes! This means you can instantly have the money you need in your account.

3. No Collateral Required

Unlike other types of loans, instant online loans typically don’t require purchasing collateral, like your house or car. That’s a big relief because it means you won’t risk losing your valuable possessions if you can’t repay the loan.

4. Flexibility in Loan Amounts

Online lenders often offer a range of loan amounts to choose from. Whether you need a small loan to cover unexpected expenses or a larger one for a major purchase, you can find an instant online loan that suits your needs.

5. Bad Credit? No Problem!

Here’s some great news: Your credit score doesn’t have to be perfect to get an instant online loan approved. Many online lenders are more lenient when it comes to credit checks. So, even with less-than-stellar credit, you still have a good chance of being approved.

6. Transparency in Fees and Terms

With instant online loans, you’ll know exactly what you’re getting into. Lenders are required to disclose all fees, interest rates, and repayment terms upfront. This transparency helps you make informed decisions and avoid surprises down the road.

7. 24/7 Availability

Emergencies don’t follow a 9-to-5 schedule, and neither do online loans. And with platform, borrow money instantly anytime, day or night. This 24/7 availability can be a lifesaver when you need cash urgently, even during weekends or holidays.

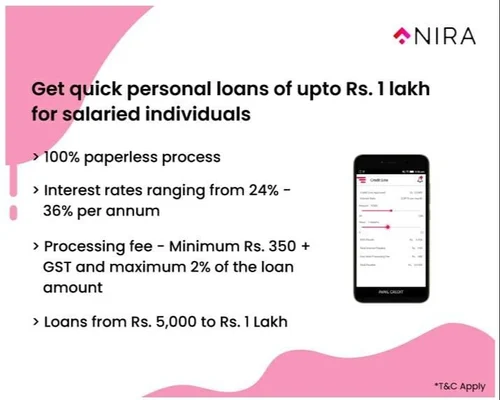

8. Paperless Process

Say goodbye to stacks of paperwork. App for instant loan are eco-friendly and hassle-free because they’re entirely digital. You’ll upload your documents online, eliminating the need for endless forms and photocopies.

9. Competitive Interest Rates

While interest rates can vary depending on your credit and the lender, many online loans offer competitive rates. Shopping around and comparing offers can help you find the best deal to suit your budget.

10. Repayment Flexibility

Online loans often come with flexible repayment options. You can choose a repayment plan that fits your budget, whether a short-term loan that’s paid back quickly or a longer-term loan with lower monthly payments.

11. Avoid Embarrassing Questions

We’ve all been there – standing in a bank, being grilled about our financial situation. Online loans spare you from these awkward in-person conversations. Your application is handled discreetly and professionally online.

12. Use the Money for Anything

Unlike some loans that restrict how you can use the funds, instant online loans give you the freedom to use the money for whatever you need. It’s your call, whether it’s medical bills, home repairs, or a well-deserved vacation.

In conclusion, instant online loans are like a financial superhero when in a tight spot. They’re quick, convenient, and accessible to almost everyone. With transparent terms, flexible repayment options, and the ability to apply from the comfort of your home, they’ve become a go-to solution for many people facing unexpected expenses. Additionally, the option to pay later provides even more flexibility for borrowers, allowing them to manage their finances with ease.