The lending space is undergoing massive change in today’s rapidly changing digital environment, particularly due to the advent of instant loan apps. These finance loan apps have completely transformed the way people borrow money by making it fast and easy to get a loan with a few taps on the phone. This article will discuss how instant loan apps are disrupting the lending space.

Accessibility and Convenience:

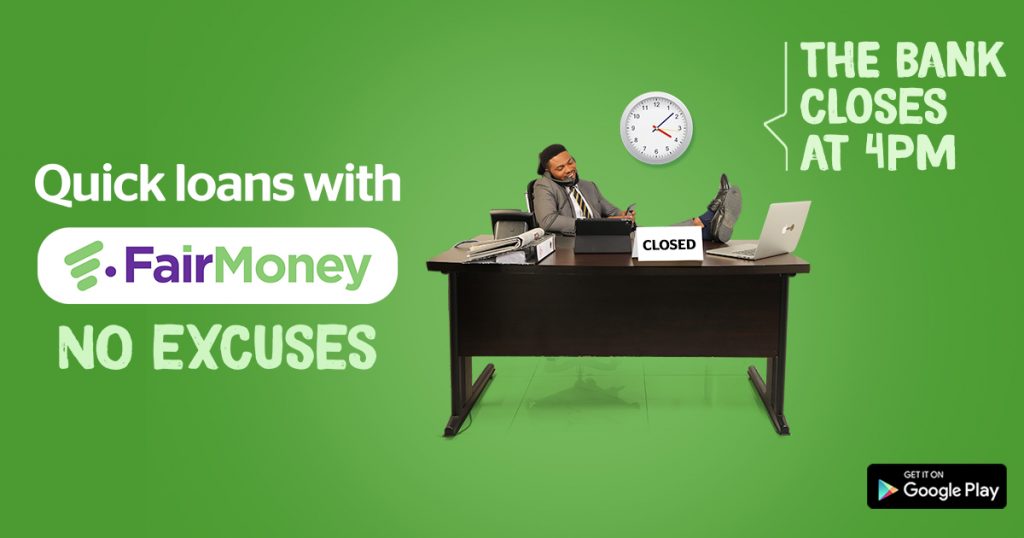

Perhaps the most important advantage of instant loan apps is free access and convenience. Lending institutions usually conduct a long application process with considerable paperwork and banking time for the approval of the loan. Instant loan app streamlines the process and offers users the opportunity to receive the required sum of money as soon as possible with the least paperwork and documentation.

Speedy Approval and Disbursement:

To ensure borrowers have access to funds in times of need, instant loan apps use sophisticated technology, including AI and ML algorithms, to expedite the acceptance and issuance process. Unlike any conventional bank, which can take days or weeks to approve loan applications and disburse funds, instant loan apps provide approval decisions in seconds and transfer cash to borrowers’ accounts in minutes. This makes it easier for borrowers with pressing financial requirements or sudden unexpected expenses.

Ensuring Personalized Loan Options:

Instant loan apps offer personalized loan options for every borrower. Every user is unique, with various needs, capacities, and preferences, such as business loan or home loan, which means they also need tailored lengths, amounts, or rates.

To crunch every user and provide them with suitable loan amounts, least interest rates for loans, and general repayment options, app developers utilize sophisticated algorithms and financial data analytics. As a result, applicants only take out the amount of money they can afford and repay on time and the rates they can actually repay. Thus, it contributes to their ultimate satisfaction and general repayment efficiency.

Financial Inclusion:

Instant loan apps can be an effective tool that enhances financial inclusion. Traditional formal lenders have stringent eligibility requirements, often including the need for the borrower to deposit precious items to secure the debt. As a result, a significant percentage of people do not have access to traditional credit facilities. In turn, instant loan apps increase the availability of credit to people by utilizing unorthodox data sources and innovative risk assessment algorithms. With improved access to transparent and feasible credit solutions, ordinary people can address their own financial needs and hence enhance their financial wellness.

Emergency Financial Emergency:

As already indicated, instant loan apps are mostly used by borrowers to address short-term financial emergencies or cash flow shortfalls. In other words, borrowers require a short-term loan in their saving account when they encounter an accident and need immediate medical coverage or when they temporarily lose their source of income, basically in emergencies. These instant loan apps make it possible for borrowers to close the financial gap and refrain from taking out high-cost alternatives, including payday loans or overdraft fees.

In summary, instant loan apps are a revolutionary change in the lending world. They provide unmatched ease of access, swiftness, and adaptability to borrowers. However, their widespread use of Atm card app also raises critical concerns about consumer safeguards, regulatory adherence, and responsible lending practices. As this landscape progresses, stakeholders must cooperatively work to harness the transformative capacity of instant loan apps. At the same time, they must effectively address associated obstacles and risks.